Christmas is full of excitement, lights, and family traditions. But it can also bring something a lot of dads feel more than they admit. Pressure.

The pressure to buy gifts, plan days out, host family, and make everything feel magical. All of that adds up, both mentally and financially.

If you have ever looked at your December bank balance and wondered how it disappeared so fast, you are far from alone. The good news is that there are simple and realistic ways to manage the money side of Christmas without missing out on the joy of it.

Here is how dads can reduce financial stress and still create a warm, memorable festive season.

1. Start with a simple budget

You do not need spreadsheets or apps. A short list works just as well.

Write down:

-

Who you are buying for

-

How much you can afford for each person

-

Any extra costs like food, travel, outfits, or school events

A clear plan stops surprise spending and gives you confidence. It is not about limiting the fun. It is about knowing where your money is going.

2. Be honest about what you can afford

It is easy to get swept up in sales, offers, and pressure to buy the “perfect” gift. But the truth is this. Kids remember the experience, not the price tag.

They remember the games you played, not how much the presents cost.

Buying within your means is not something to feel guilty about. In fact, it sets a great example for your children.

3. Spread the cost with small weekly buys

If December feels expensive, spread some of the cost earlier in the month.

Pick up stocking fillers, snacks, or wrapping supplies during your regular food shop. Small purchases feel easier to manage and reduce the hit when the big week arrives.

4. Embrace second hand and pre loved

This is one of the smartest money saving tactics around.

Many toys, books, and games are used for only a few months before they are passed on. Buying pre loved saves money and is better for the planet.

Charity shops, local selling groups, and online marketplaces are full of great quality items that cost a fraction of the original price.

5. Suggest a family gift swap

If your extended family is large, buying for everyone can become overwhelming.

A simple alternative is a secret gift exchange where each person buys just one gift. It keeps the fun and removes a huge amount of pressure.

Most families are relieved when someone suggests it.

6. Cut back on the “extras” that sneak up on you

These are the hidden costs that add up fast:

-

Matching pyjamas

-

Party food

-

Decorations

-

School fair donations

-

Extra days out

Choose the ones that genuinely matter to you and skip the rest. You do not need five kinds of festive snacks to have a good time.

7. Make a few things at home

Homemade gifts or treats can save money and become lovely family traditions.

Ideas include:

-

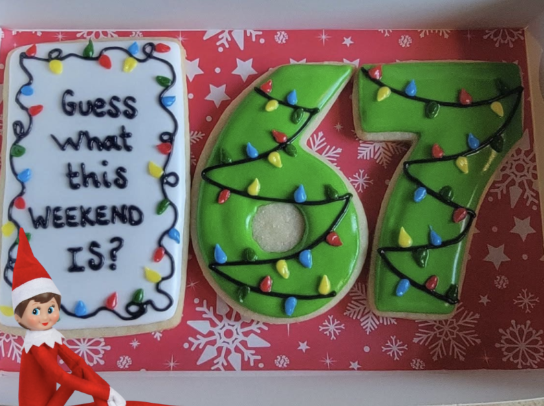

Baking biscuits for teachers

-

Making your own gift tags

-

Creating simple photo gifts

These activities cost less but feel thoughtful and personal.

8. Protect your January

It is tempting to push the stress into next month, but your future self will thank you for avoiding debt if you can.

If a purchase means stress later on, it is a sign to pause.

Christmas is one day. Your peace of mind lasts a lot longer.

9. Talk to your partner

Money conversations can be uncomfortable, but they make a huge difference.

Agree your budget together. Share concerns early. Stay on the same page before spending starts.

Teamwork always reduces stress.

Final thought

Christmas is not measured by the cost of the gifts. It is measured by the feeling in the house.

The calm moments, the silliness, the shared memories.

By keeping things simple and realistic, you protect that magic without stretching yourself too thin.

Your kids do not need a perfect Christmas. They need a present parent who is not weighed down by worry.

And that is a gift no money can buy.